The Unseen Force Reshaping Wall Street

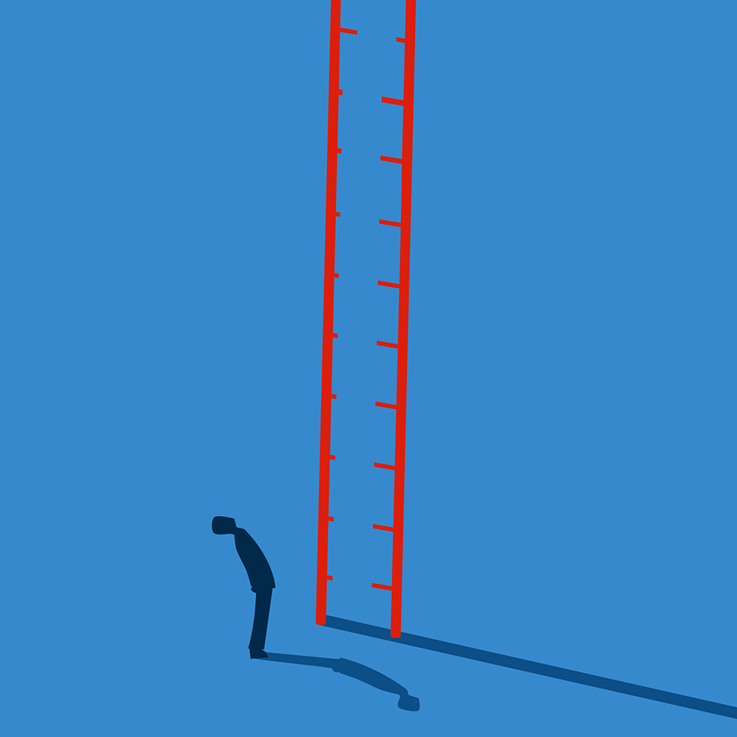

Remember those late-night sessions cramming for exams, or the sheer grind of your first entry-level job? The feeling that you're paying your dues, learning the ropes, and slowly but surely climbing the ladder? For many of us, especially those eyeing the fast-paced world of investment banking, that grind — the financial modeling, the endless data analysis, the meticulous report generation — has always been a rite of passage. It's tough, yes, but it builds character, right?

But what if I told you that this rite of passage might be rapidly changing, perhaps even fading, thanks to a new player on the block? No, it's not another disruptor startup; it's AI, specifically OpenAI, and their intriguing, slightly ominous initiative: Project Mercury.

Recently, news broke that OpenAI, the powerhouse behind ChatGPT, is quietly hiring a battalion of ex-investment bankers. Their mission? To train an advanced AI to master the very tasks that form the bedrock of junior analyst roles in investment banking. This isn't just about streamlining; it's about automating the core functions that traditionally define the initial years of a banking career. And honestly, it's got me thinking: are we on the cusp of a major paradigm shift, where human diligence gives way to algorithmic efficiency?

The Problem: The Drudgery of Entry-Level Finance

Let's be real. While the allure of Wall Street is undeniable, the day-to-day work for a junior investment banking analyst can often feel less like strategic wizardry and more like sophisticated data entry and number crunching. Think hundreds of hours spent:

- Building complex financial models: These are the backbone of valuations, M&A deals, and capital raises. They require meticulous data input, formula integrity, and constant updates.

- Analyzing market data: Sifting through endless reports, news, and economic indicators to spot trends and inform decisions.

- Crafting presentations and pitch books: Summarizing vast amounts of information into digestible, client-ready formats, often under insane deadlines.

- Due diligence: Pouring over company financials, legal documents, and industry reports to assess risks and opportunities.

These tasks are crucial, no doubt, but they're also highly repetitive, time-consuming, and prone to human error. They're the kind of tasks that, frankly, an intelligent machine could excel at — if trained correctly.

Enter Project Mercury: OpenAI's Deep Dive into Finance

This is where Project Mercury comes into play. According to various reports, OpenAI isn't just dabbling in finance; they're making a concerted effort to build an AI that can handle these sophisticated financial operations. By recruiting a team of over 100 former investment bankers, they're essentially reverse-engineering the human expertise that goes into financial modeling and analysis, feeding it directly into their AI models.

Why ex-bankers, you ask? Because who better to teach an AI the nuances of a leveraged buyout model or the intricacies of discounted cash flow analysis than someone who's lived and breathed it? This isn't just about general data processing; it's about imbuing the AI with specialized domain knowledge, enabling it to understand context, identify anomalies, and even anticipate trends in a way generic LLMs might struggle with.

How AI can take on these tasks:

- Automated Financial Modeling: Imagine an AI that can ingest raw financial statements, market data, and company guidance, then instantly spit out a fully functional three-statement model, complete with valuation metrics. It could run sensitivity analyses, scenario planning, and even identify key drivers far faster than any human.

- Intelligent Data Analysis: LLMs are phenomenal at pattern recognition. An AI could sift through millions of news articles, SEC filings, and research reports in seconds, identifying relevant information and synthesizing insights that would take a human weeks to uncover.

- Efficient Report Generation: From drafting initial sections of pitch books to generating due diligence reports, AI could structure, populate, and even format these documents, freeing up human analysts for more qualitative, client-facing work.

This isn't just theoretical; it's already happening in various forms, and Project Mercury aims to push these capabilities to an unprecedented level. The goal, as some sources suggest, is to create an AI that can automate "100% of entry-level tasks". Pretty staggering, right?

The Results and Insights: A New Frontier for Wall Street

So, what does this mean for the financial industry?

- Unprecedented Efficiency: Imagine a world where financial models are built and updated in minutes, not days. This dramatically speeds up deal cycles and decision-making.

- Reduced Costs: Automating labor-intensive tasks can significantly cut down operational expenses for investment banks, potentially leading to more competitive services.

- Enhanced Accuracy: While humans are prone to error, well-trained AI models can execute repetitive tasks with near-perfect accuracy, reducing the risk of costly mistakes.

- Focus on Higher-Value Work: If machines handle the grunt work, human analysts and associates can pivot to more strategic thinking, client relationship management, and complex problem-solving that still requires human intuition and empathy. This could redefine what it means to be a "junior" in finance.

It's tempting to view this as a doomsday scenario for aspiring bankers. But is it really? Or is it an opportunity to evolve, to shed the monotonous aspects of the job and embrace a more intellectually stimulating role? I believe it's the latter, but it requires a proactive approach from current and future professionals.

Limitations and Open Questions: Where Humans Still Shine (for now)

While Project Mercury sounds revolutionary, it's crucial to acknowledge the current limitations of AI, especially in a field as dynamic and human-centric as investment banking:

- Nuance and Judgment: Financial markets are driven by human psychology, geopolitical events, and unexpected black swan incidents. AI can process data, but can it truly grasp the nuance of a client relationship, the art of negotiation, or the judgment needed in a crisis? I'm skeptical.

- Ethical Considerations: Who is accountable when an AI makes a bad recommendation leading to significant losses? The ethical and regulatory frameworks for AI in high-stakes finance are still very much in their infancy.

- Creative Problem Solving: While AI excels at structured tasks, complex deals often require out-of-the-box thinking, creative structuring, and bespoke solutions that go beyond pattern recognition. This is where human ingenuity remains irreplaceable.

- The "Black Box" Problem: As I've discussed in previous posts, understanding why an LLM makes a certain decision can be opaque. In finance, where transparency and auditability are paramount, this "black box" nature can be a significant hurdle.

So, while AI might handle the how, the why and the what-if scenarios, particularly those requiring foresight and empathy, will likely remain in the human domain for the foreseeable future. The question then becomes: How do we, as humans, adapt our skill sets to complement, rather than compete with, these increasingly capable machines?

Evolving with the Machine

Project Mercury isn't just a development from OpenAI; it's a loud wake-up call for anyone in finance, particularly those early in their careers. The traditional path of "paying your dues" through endless modeling and data entry is being disrupted.

This isn't about AI replacing all jobs, but rather transforming how those jobs are done. The demand for financial professionals who can interpret AI outputs, leverage these tools effectively, communicate complex insights, and build strong client relationships will likely skyrocket. The future of investment banking isn't human versus AI; it's human plus AI, where our uniquely human skills — critical thinking, emotional intelligence, creativity, and ethical judgment — become even more valuable.

So, if you're an aspiring investment banker, or even a seasoned one, now is the time to pivot. Learn to collaborate with AI, understand its capabilities and limitations, and focus on developing those distinctly human competencies that no algorithm can replicate. Your career might not be on borrowed time, but it's definitely entering an exciting new era of evolution.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!